Cryptocurrency has become one of the fastest-growing ways to build wealth, attracting people from all walks of life. Whether you’re drawn to the thrill of day trading, the steady growth of long-term investments, or the innovative potential of NFTs and DeFi, there are many paths to wealth in this dynamic field. But with high rewards come high risks, making it essential to understand the strategies that can lead to success—and the pitfalls to avoid. In this article, we’ll explore actionable ways to make money with cryptocurrency, from passive income streams to high-stakes investments.

10 Ways to Get Rich off Crypto

Here’s a breakdown of 10 ways to potentially get rich with cryptocurrency, focusing on popular strategies shared by crypto experts:

1. Investing in Presales: Many investors jump into presales of promising coins to get them at the lowest prices, aiming to profit when the token value rises after public launch. This strategy requires research and timing, as not all presales are successful.

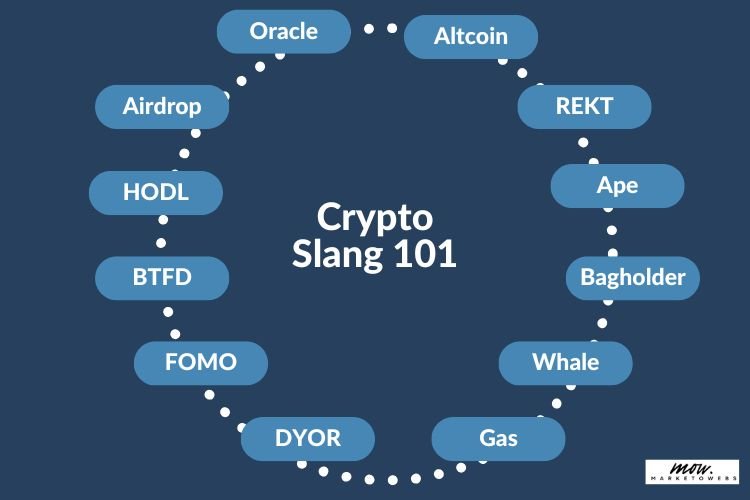

2. Airdrops: Crypto projects sometimes distribute free tokens to build awareness. By participating in airdrops, you can receive new tokens, which may increase in value over time.

3. Day Trading: This involves buying and selling cryptocurrencies within short time frames to capitalize on market fluctuations. Day trading requires technical analysis skills and a good understanding of the market.

4. Holding: This long-term strategy involves holding onto your cryptocurrency, betting on significant price increases over time. Bitcoin and Ethereum are popular choices for this approach.

5. Staking and Interest: Some platforms allow you to earn rewards by staking your crypto or holding it in interest-bearing accounts. Platforms like OKX and Nexo offer returns for staking certain tokens, turning idle assets into income streams.

6. Play-to-Earn Crypto Games: These games reward players with tokens for completing in-game tasks. Some popular play-to-earn games allow players to make money while enjoying gameplay, although earnings vary greatly.

7. Crypto Yield Farming & Lending: Yield farming involves lending crypto on DeFi platforms to earn interest. It’s a popular method in DeFi, with platforms like Aave offering interest for providing liquidity to the market.

8. Faucets: These are websites that give away small amounts of crypto in exchange for completing tasks. While faucet payouts are usually small, they can be a starting point for beginners to accumulate crypto without investment.

9. DAOs: Decentralized Autonomous Organizations (DAOs) reward members who contribute to governance and participate in collective decision-making. Earnings vary but can be rewarding for those involved in the project’s growth.

10. Mining: Traditional mining, especially for Bitcoin, remains a way to earn crypto. With the right hardware and access to low-cost electricity, mining can be profitable, though initial setup costs are high.

Each of these methods comes with varying levels of risk and potential reward. While some strategies like HODLing or staking offer passive income opportunities, others like day trading and yield farming require a more active approach and a solid understanding of the crypto market. Conduct thorough research to identify which methods align best with your financial goals.

Can You Get Rich with Cryptocurrency? Things to Keep in Mind

Investing in cryptocurrency has led many to substantial gains, but it’s not a guaranteed path to wealth. Here are some things to consider to make informed decisions:

1. High Volatility: Cryptocurrencies like Bitcoin and Ethereum are known for price fluctuations. While these swings offer potential for profit, they also come with high risk. Be prepared for both gains and losses.

2. Investment Timing: Getting into promising projects early can yield significant returns. However, it’s important to research projects thoroughly. For example, new tokens often start with lower prices, providing a good entry point if the project has potential for growth.

3. Different Profit Strategies: There are various ways to earn in crypto, including buying and holding, trading, staking, yield farming, and participating in airdrops. Each method has a unique risk profile and time commitment. Buying and holding is more suitable for long-term gains, whereas trading requires constant market monitoring.

4. Security Risks: The crypto space is prone to hacks, scams, and regulatory issues. Investing in reputable exchanges and keeping assets in secure wallets can mitigate some risks.

5. Regulatory Environment: Cryptocurrency regulations vary widely by country. Being aware of your region’s laws and any potential tax implications can help avoid unexpected issues.

6. Don’t Treat It as a “Get Rich Quick” Scheme: While some have seen quick profits, most successful crypto investors approach it as a long-term investment. Staying informed, understanding the technology, and recognizing market trends are essential to achieving sustainable returns.

By keeping these factors in mind, you can build a thoughtful approach to investing in cryptocurrency while managing risks effectively. For more insights, you can check sources like Investopedia and Crypto News.

Conclusion

Cryptocurrency offers diverse opportunities for wealth creation, from long-term investments to active trading and passive income methods. However, the road to financial success in crypto requires informed decision-making, resilience, and a willingness to embrace market volatility.

By understanding the fundamentals, managing risk, and keeping pace with the latest developments, investors can position themselves for potential gains. Remember, crypto’s high rewards come with high risks, so always invest wisely and never risk more than you can afford to lose.